14 free payroll templates you can use to manage payroll — from calculating payroll to keeping track of your budget, these customizable templates are designed to help you streamline your company’s payroll process.

If you own a company with more than one employee, you need a reliable payroll management system to adequately compensate your employees for the hours of work they've put in.

But still, why would payroll templates be your first choice instead of an old-school calculator?

Well, payroll templates are a pretty handy asset if you're looking for a simple solution to help you:

On top of all that, ready-made payroll templates can save both you and your managers dozens of hours that could be invested in more burning issues.

Whether your payroll cycle requires you to issue payments on a weekly or monthly basis, free payroll templates you can download and edit are specifically tailored to meet your company's needs.

Here are 14 of them you can use right away.

Regardless of whether you issue payments on a weekly basis or you'd simply like to stay on top of your employees' payroll week after week, Weekly Payroll Templates can help you speed up each process.

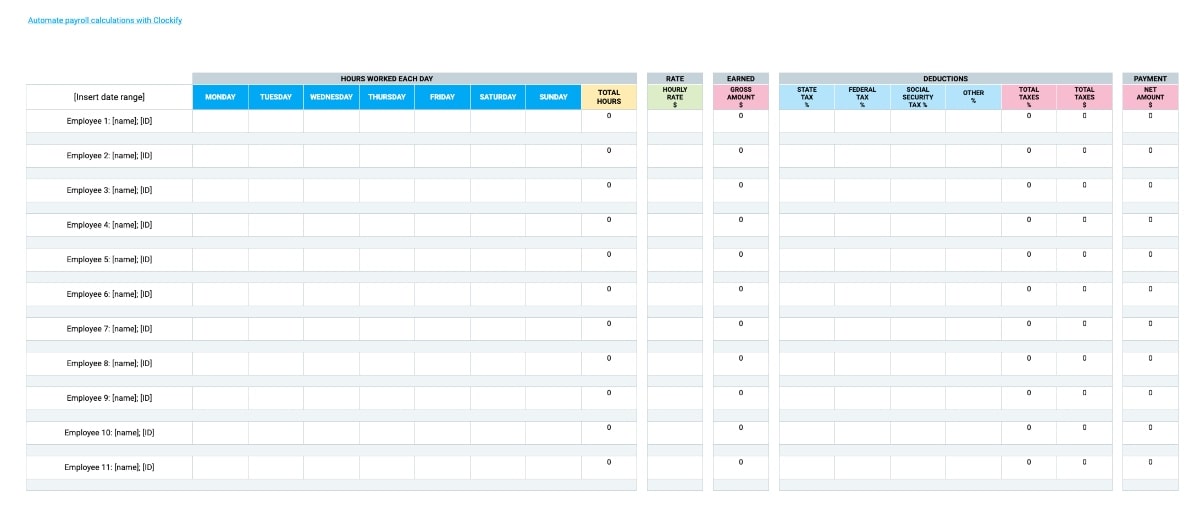

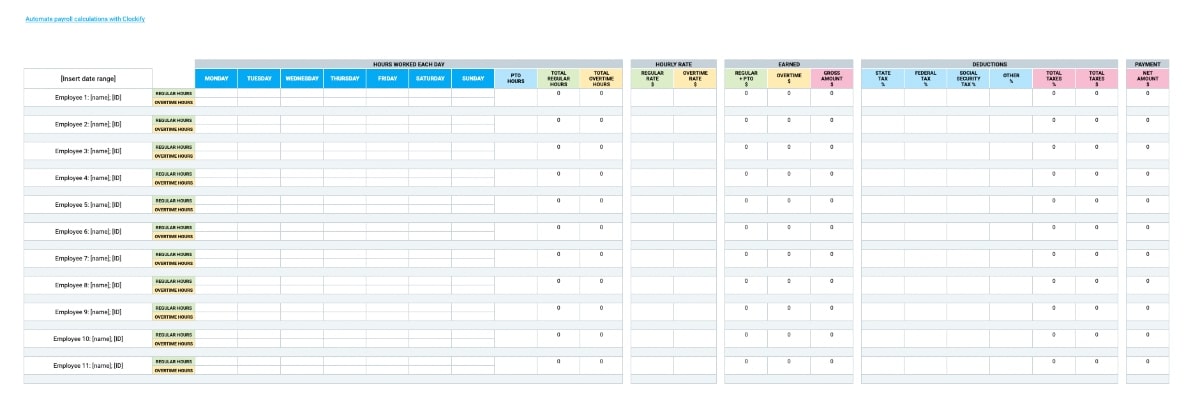

If you're looking for a simple spreadsheet that will help you keep your company's payroll data in one place, Basic Weekly Payroll Template could be the perfect choice for you.

What is the Basic Weekly Payroll Template?

The Basic Weekly Payroll Template is a ready-made template you can edit and customize depending on your company's payroll system.

This spreadsheet is designed to help you:

Why use the Basic Weekly Payroll Template?

You should go with the Basic Weekly Payroll Template if you're in search of a simple, yet accurate system to stay on top of your company's payroll process week after week.

How best to use the Basic Weekly Payroll Template?

After you've downloaded the template, start by adding:

As soon as you've added this information to the template, you'll automatically see the change in the Gross Amount column.

After you've added all the necessary deductions (State tax, Federal tax, Social Security tax, etc.), you'll be able to see the exact net amount for each employee.

In case you employ non-exempt workers, your payroll calculations could be a bit more complex, especially if your employees' contracts include overtime.

This is where the Weekly Payroll Template with overtime comes into the picture.

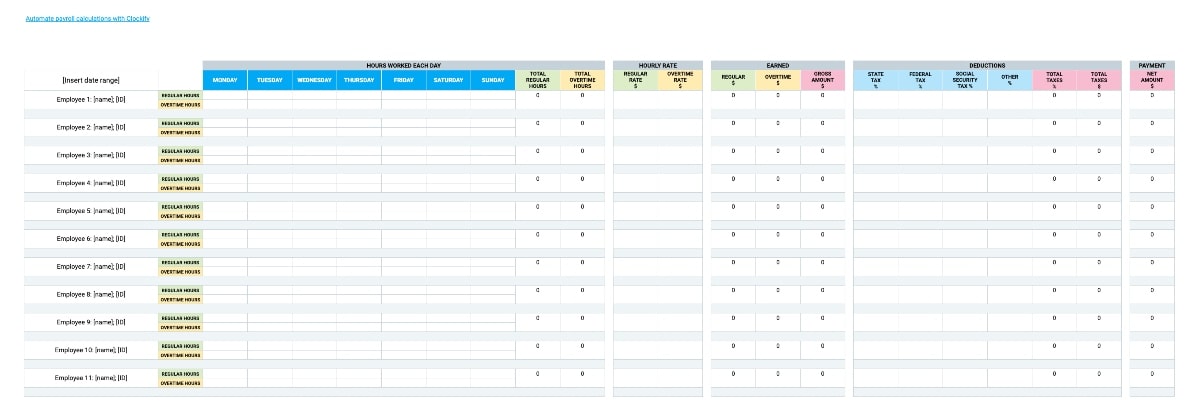

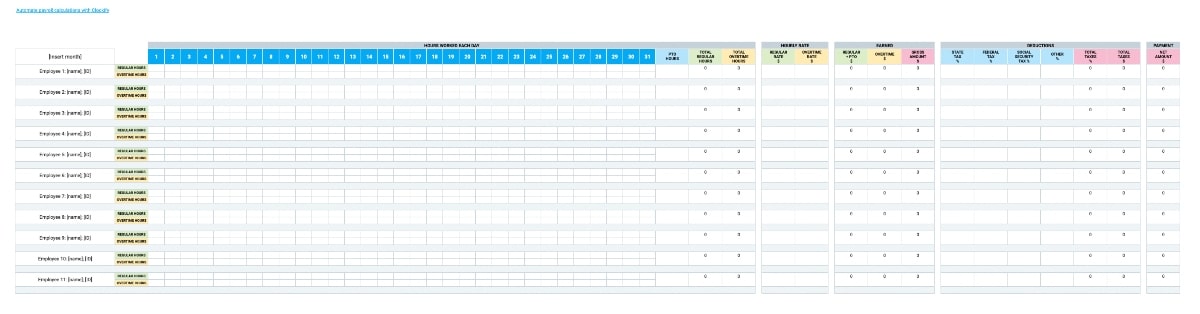

What is the Weekly Payroll Template with overtime?

The Weekly Payroll Template with overtime helps you run an accurate payroll by letting you calculate the exact net amount based on employees' regular hours and their overtime.

Why use the Weekly Payroll Template with overtime?

If you're in search of an easy-to-use, yet accurate spreadsheet that can help you stay on top of both your employees' overtime and their exact take-home pay, then try using the Weekly Payroll Template with overtime.

How best to use the Weekly Payroll Template with overtime?

As soon as you've downloaded the Weekly Payroll Template with overtime and added the necessary employee information, you can start by putting in the exact hours they've worked each day, both regular and overtime.

After you've added both the regular and overtime hourly rate, you'll get the exact gross amount. Then, add all the necessary deductions — and you'll see the changes in the Net amount column as well.

If you've decided to give your employees a chance to take paid time off, you'll need a comprehensive payroll calculation system to make sure they're adequately compensated — and the Weekly Payroll Template with PTO can help you avoid miscalculations.

What is the Weekly Payroll Template with PTO?

The Weekly Payroll Template with PTO is a customizable spreadsheet that you can use to accurately process payroll even if your payment system requires you to include PTO in your calculations.

Why use the Weekly Payroll Template with PTO?

In case you've introduced a PTO policy and you want to keep an eye on your employees' pay week in and week out, then the Weekly Payroll Template with PTO will reduce the hours you need to put in to obtain the accurate numbers.

How best to use the Weekly Payroll Template with PTO?

When you download the Weekly Payroll Template with PTO, you can start by adding employee information and the hours they worked each day.

Don't forget to add the number of time off hours in the PTO column and your employees' hourly rate.

This way, you'll get the exact gross amount for each employee.

After you've added all the deductions — including State tax, Federal tax, Social Security tax, and other deductions — you'll notice the changes in the Net amount column and see the exact amount your employees will receive at the end of the week.

If your business requires you to include both overtime and PTO in your payroll calculations, you don't need to create a payroll processing system from scratch.

Try out the Weekly Payroll Template with overtime and PTO as a simple workaround.

What is the Weekly Payroll Template with overtime and PTO?

The Weekly Payroll Template with overtime and PTO is a detailed spreadsheet that you can edit to get the most suitable payroll calculation for your business.

Why use the Weekly Payroll Template with overtime and PTO?

In case you need to include both overtime hours and PTO in your payroll processing, then the Weekly Payroll Template with overtime and PTO can help you simplify this process.

How best to use the Weekly Payroll Template with overtime and PTO?

After you've downloaded the Weekly Payroll Template with overtime and PTO, start by filling out the necessary employee information. Then, add the number of regular and overtime hours for each employee, as well as the PTO hours, if applicable.

As soon as you've added everyone's hourly rate, you'll see the changes in the Gross amount column.

Then, after adding the percentage of the deduction, you'll obtain the exact net amount for each employee.

If you've decided to set a monthly pay period, you'll need to ensure that your payroll calculating system runs as smoothly as possible — and this is where the monthly payroll templates can be quite convenient.

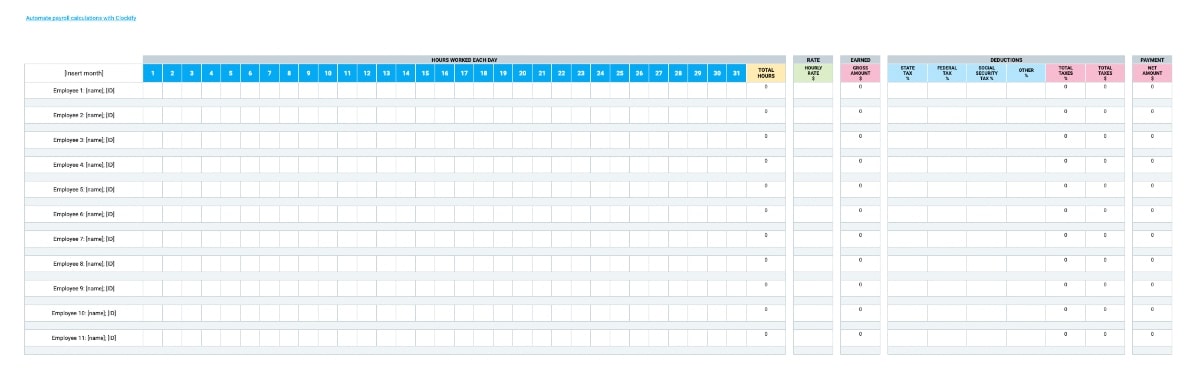

If you need a simple and practical payroll spreadsheet that will contain all the relevant payment information and help you calculate payments month in and month out, then the Basic Monthly Payroll Template could be a great option for you.

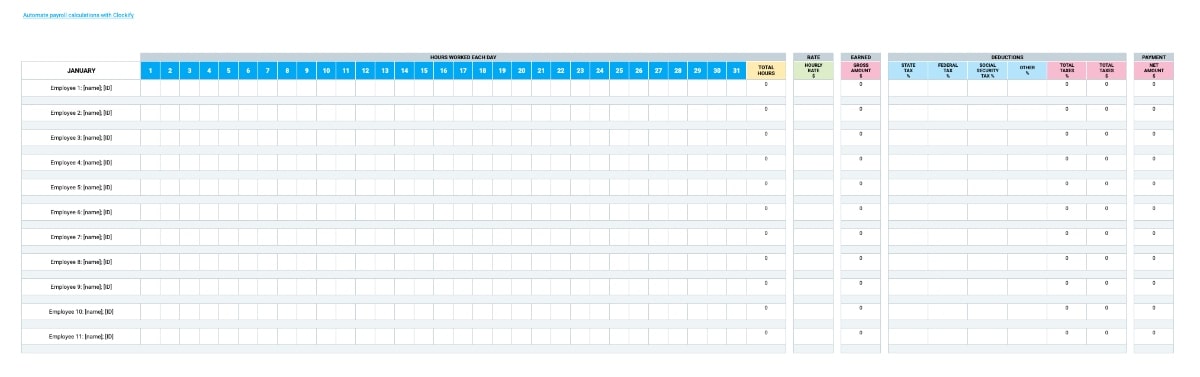

What is the Basic Monthly Payroll Template?

The Basic Monthly Payroll Template is a simple payroll spreadsheet specifically tailored to assist you in calculating the exact take-home pay for all employees on a monthly basis.

Why use the Basic Monthly Payroll Template?

If you're in search of a simple customizable spreadsheet that allows you to track employees' work hours and convert them into payroll, then the Basic Monthly Payroll Template will help you do just that, with minimal effort.

How best to use the Basic Monthly Payroll Template?

As soon as you've downloaded the Basic Monthly Payroll Template, you can start using it.

You just need to:

After you've added all the basic information, you'll see the changes in the Gross amount column.

Then, immediately after you've added all the applicable deductions, you'll obtain the total net amount for each employee.

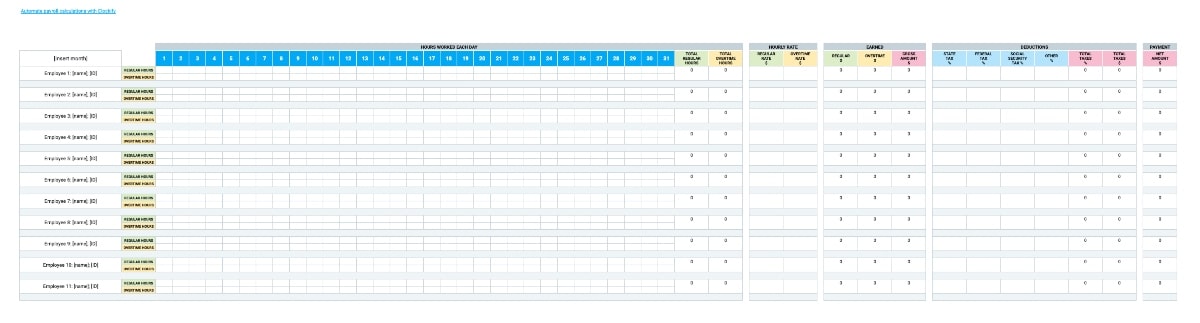

If you need a speedy way to calculate your employees' monthly payments, but you also have to include their overtime hours in the calculation, then the Monthly Payroll Template with overtime can help you optimize this process.

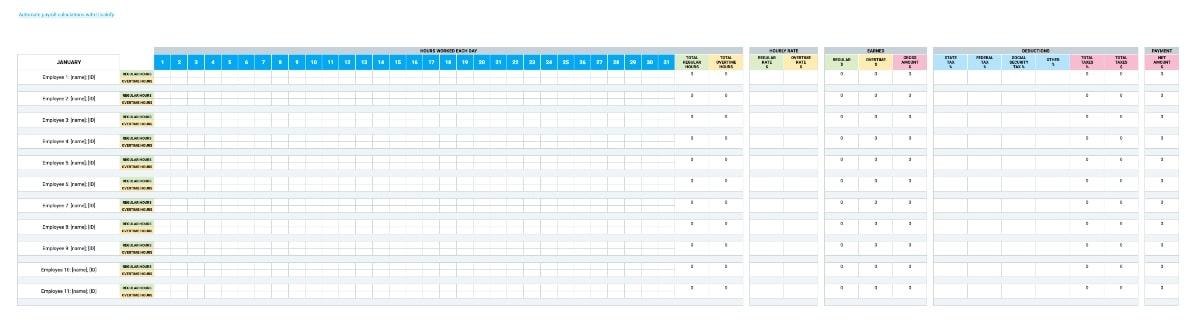

What is the Monthly Payroll Template with overtime?

The Monthly Payroll Template with overtime is a detailed, but easy-to-use, spreadsheet that can simplify your payroll process, despite the complexities that come with tracking employees' overtime hours.

Why use the Monthly Payroll Template with overtime?

If you employ non-exempt workers who frequently work overtime, you'll need a faultless payroll calculating system to ensure that everyone is fairly compensated at the end of a month — and this is where the Monthly Payroll Template with overtime can help you out.

How best to use the Monthly Payroll Template with overtime?

Immediately after downloading the Monthly Payroll Template with overtime, you can begin by adding:

As soon as you've added all the required information, you'll see the gross amount changed.

Then, after you add the necessary deductions, you'll notice the changes in the Net amount column and get the exact amount your employees will receive at the end of a month.

Giving your employees the option to take paid time off does not have to complicate your payroll calculations — if you find a reliable system to do the work for you.

Luckily, that's exactly what the Monthly Payroll Template with PTO is designed to do.

What is the Monthly Payroll Template with PTO?

The Monthly Payroll Template with PTO is a detailed customizable spreadsheet that helps you obtain the exact payroll data within a couple of minutes.

Why use the Monthly Payroll Template with PTO?

In case you find it too complicated to calculate your employees' monthly payments by hand ever since you've implemented a PTO policy, then the Monthly Payroll Template with PTO can take the burden off your shoulders.

How best to use the Monthly Payroll Template with PTO?

After you've downloaded the Monthly Payroll Template with PTO, add the basic information for each employee (name, ID).

Then, after you've added the exact hours each employee has worked throughout the month, don't forget to add the total number of PTO hours and their hourly rate — and you'll notice the change in the Gross amount column.

Immediately after you've put in all the applicable deductions, you'll see the total net amount for each employee.

In case your payroll management involves more complex calculations that include both overtime and PTO, the Monthly Payroll Template with overtime and PTO can make this task less challenging.

What is the Monthly Payroll Template with overtime and PTO?

The Monthly Payroll Template with overtime and PTO is an elaborate spreadsheet that lets you manage payroll on a monthly basis, despite all the difficulties that come with including both overtime and PTO hours.

Why use the Monthly Payroll Template with overtime and PTO?

If you'd like to automate the process of calculating your company's monthly payroll — but you still need to pay attention to the total number of overtime and PTO hours for each employee — then you could try using this template.

How best to use the Monthly Payroll Template with overtime and PTO?

First, download the Monthly Payroll Template with overtime and PTO and add the important employee information.

Then, you can begin by adding both overtime and regular hours worked.

Continue by adding the total number of PTO hours for each employee, as well as their hourly rate.

You'll see the gross amount automatically calculated for each employee.

Then, after adding all the applicable deductions (State tax, Federal tax, Social Security tax, etc.), you'll be able to see the total net amount for each employee.

If you're looking for a comprehensive system that helps you store all your yearly payroll data in one place, then the Yearly Payroll Templates are just right for you.

If you'd like to build and implement a simple payroll calculating system — but you don't have much time on your hands — you can try using a ready-made payroll template that keeps all your yearly payroll calculations safely stored.

What is the Basic Yearly Payroll Template?

The Basic Yearly Payroll Template is an easy-to-use spreadsheet that you can edit and customize according to your organization's payroll needs.

Why use the Basic Yearly Payroll Template?

If you need a neat, yet accurate payroll template that lets you get a clear overview of your employees' payments throughout the year, the Basic Yearly Payroll Template can be your go-to solution.

How best to use the Basic Yearly Payroll Template?

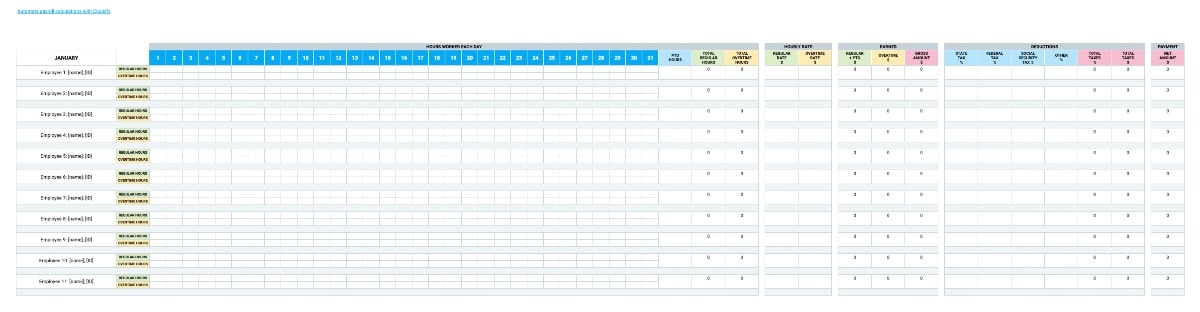

As soon as you've downloaded the Basic Yearly Payroll Template, you can add the necessary employee information (name, ID).

Then, continue by adding all the hours each employee has worked per day, as well as their hourly rate.

Immediately after, you'll see the changes in the Gross amount column.

After you've inserted the necessary deductions, the counter will automatically calculate the total net amount for each employee.

Repeat the same steps for each month in a year.

Calculating payroll when you're required to include overtime hours does not have to be time-consuming — if you introduce an accurate payroll calculating system.

Luckily, the Yearly Payroll Template with overtime might be a good fit for your organization.

What is the Yearly Payroll Template with overtime?

The Yearly Payroll Template with overtime is a comprehensive, but simple-to-use spreadsheet that helps you stay on top of your payroll calculations throughout the year.

Why use the Yearly Payroll Template with overtime?

If your employees' contracts include overtime, you'll need a detailed payroll management system to avoid miscalculations before you issue their paychecks.

How best to use the Yearly Payroll Template with overtime?

After you've downloaded the Yearly Payroll template with overtime, you'll need to add:

Immediately after, the counter will calculate the gross amount for each employee whose data you've put in.

Don't forget to fill in the Deduction columns and you'll instantly see the total net amount for each employee automatically calculated.

Repeat the same steps for each month in a year.

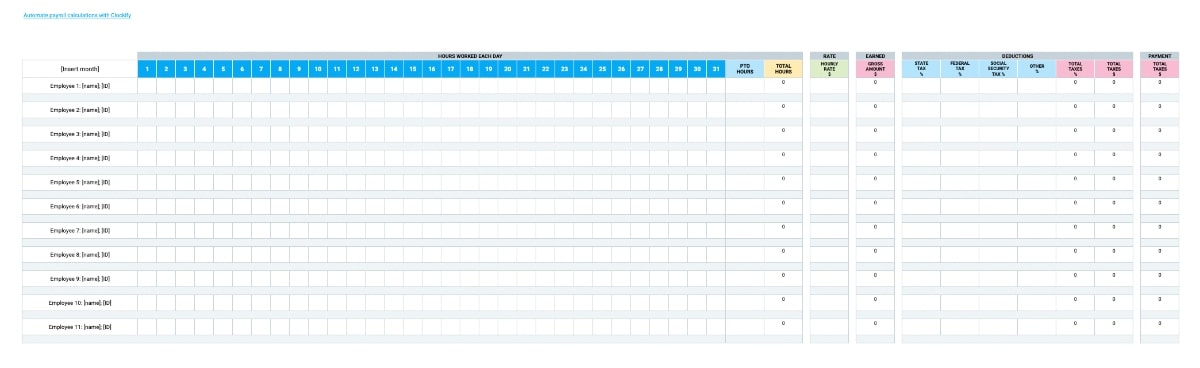

Obtaining payment-related numbers and staying on top of each employee's PTO hours — while making sure all the calculations are carried out most efficiently — can be the cause of plenty of trouble, especially in large companies.

But, the Yearly Payroll Template with PTO can help steer clear of payroll management troubles.

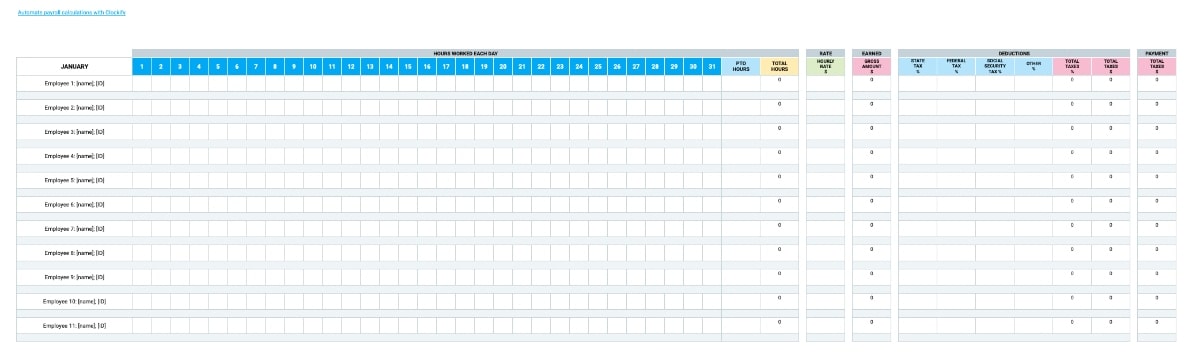

What is the Yearly Payroll Template with PTO?

The Yearly Payroll Template with PTO is a ready-made payroll spreadsheet that helps you calculate employees' payments based on the hours they've worked and the time they took off from work.

Why use the Yearly Payroll Template with PTO?

If you're looking for a customizable payroll spreadsheet with PTO that lets you store all your yearly payroll data in one place, then this template may be the answer.

How best to use the Yearly Payroll Template with PTO?

As soon as you've downloaded the template and put in all the required employee information, you can add everyone's hours, PTO hours, and hourly rate — to obtain the exact gross amount for each employee.

After you've put in the necessary deductions, you'll be able to see the total net amount for each employee.

Repeat the same steps for each month in a year.

Even if you need to include both overtime and PTO in your payroll calculations, that still doesn't mean that you have to waste hours to do the math – that's what the Yearly Payroll Template with overtime and PTO is there for.

What is the Yearly Payroll Template with overtime and PTO?

The Yearly Payroll Template with overtime and PTO is a spreadsheet specifically designed to simplify your payroll calculations even if you need to keep track of employee overtime and PTO hours.

Why use the Yearly Payroll Template with overtime and PTO?

If you're searching for an accurate and detailed payroll template to store all your payroll-related data throughout the year, then the Yearly Payroll Template with overtime and PTO might be the solution for you.

How best to use the Yearly Payroll Template with overtime and PTO?

Start by downloading the Yearly Payroll Template with overtime and PTO.

Then, add all the required employee information (name, ID), hours each employee has worked per day (both regular and overtime), as well as their total PTO hours and hourly rate.

As soon as you've put in all the required data, you'll see the gross amount automatically calculated.

Then, continue by adding the applicable deductions — and you'll obtain the exact take-home net amount for each employee.

Repeat the same steps for each month in a year.

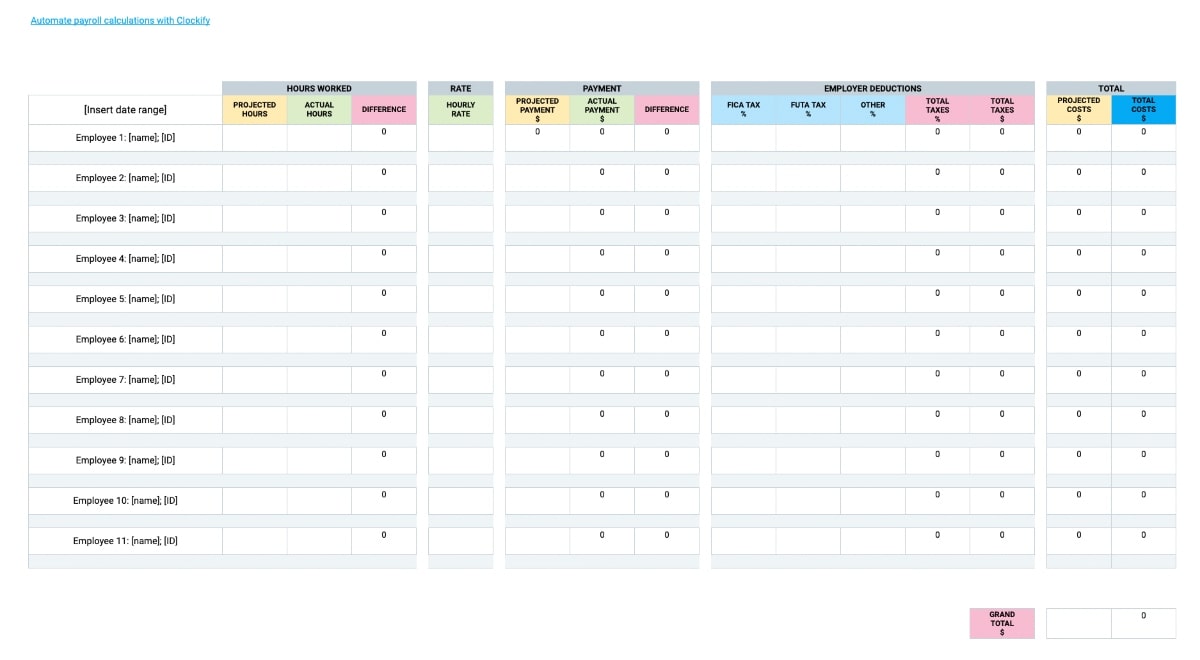

Regardless of whether you issue payments on a weekly or monthly basis, keeping track of your payroll budget is crucial if you want to have an overview of your company's overall payroll expenses — and this is where the Payroll Budget Template comes in handy.

What is the Payroll Budget Template?

The Payroll Budget Template is a customizable spreadsheet that helps you plan and keep an eye on your overall payroll budget.

Why use the Payroll Budget Template?

Use the Payroll Budget Template if you're looking for a simple way to monitor and calculate payroll costs and avoid potential miscalculations.

How best to use the Payroll Budget Template?

As soon as you download the Payroll Budget Template, you can start by adding the relevant employee information and their hourly rate.

Then, put in the hours you expect each employee to work during your chosen period of time — and you'll see the projected payment automatically calculated.

After you've added all the deductions, you'll notice the changes in the Projected costs column.

At the end of your chosen payroll period, you can put in the actual hours for each employee, and immediately see the difference between your projected payment and the actual payment you're supposed to issue.

Immediately after you've added all the data, you'll be able to see your total costs automatically calculated.

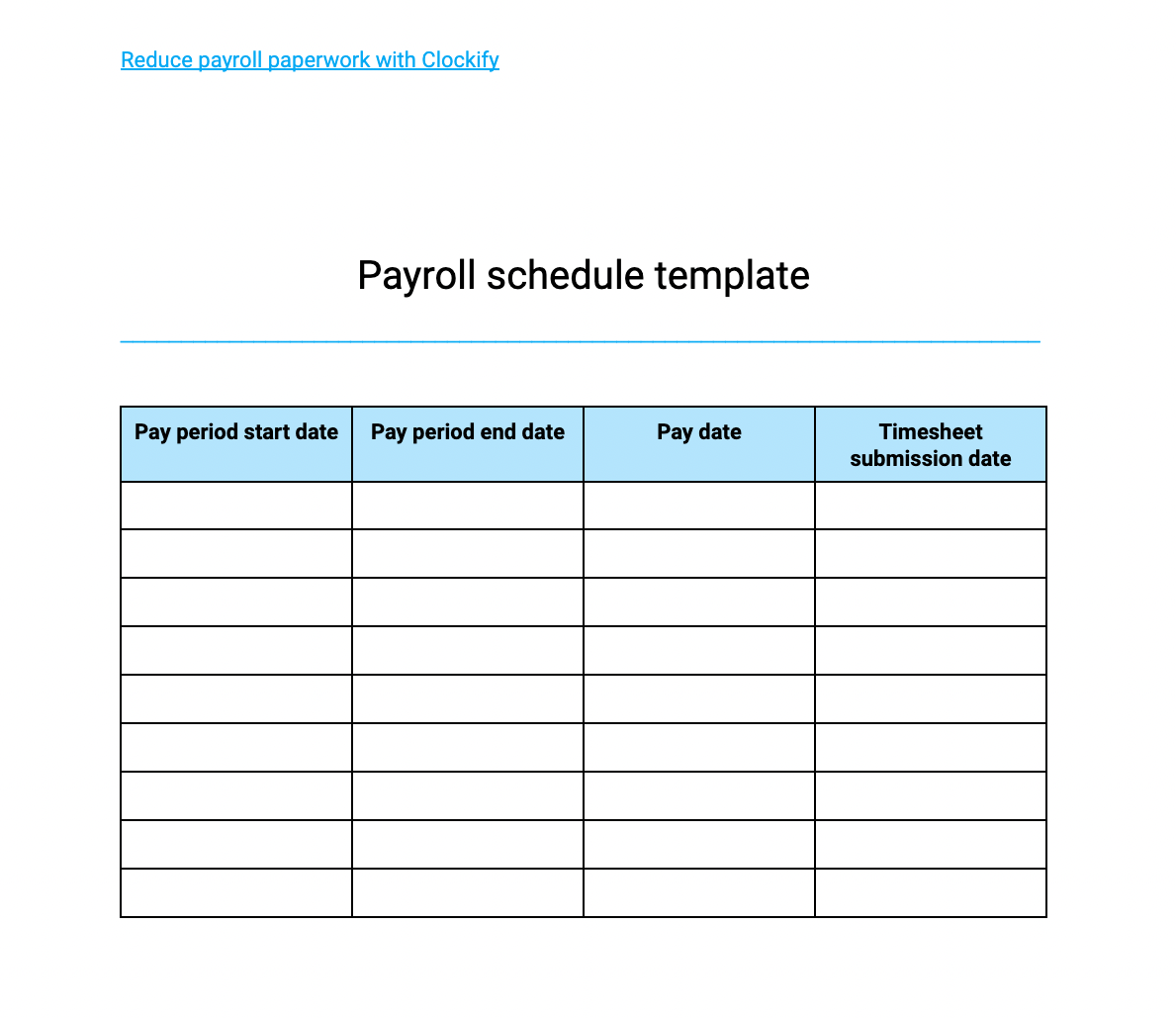

Depending on whether you employ exempt workers, non-exempt workers, or both, your company's pay period might vary.

But, regardless of your chosen pay period, your employees should always be familiar with the exact dates they'll receive their paychecks — especially if they need to submit their timesheets for approval.

Luckily, the Payroll Schedule Template can serve as a great reminder.

What is the Payroll Schedule Template?

The Payroll Schedule Template is an editable document you can use to inform employees of their pay and timesheet submission dates, but also to plan your company's payout times.

Why use the Payroll Schedule Template?

To be compliant with different laws and regulations related to payroll, you'll need to follow exact predetermined pay period dates — and this is where the Payroll Schedule Template comes in handy.

How best to use the Payroll Schedule Template?

After you've downloaded the Payroll Schedule Template, simply put in:

Payroll templates are definitely a handy tool for minimizing paperwork and eliminating manual payroll processing.

Customizable spreadsheets can save you countless hours you don't necessarily need to spend doing admin tasks.

However, despite the simplicity and ease of use that come with using payroll templates, there's still no one-size-fits-all template. If you own a large organization, chances are that a ready-made template would double your payroll management tasks instead of making your payroll processing tasks easier.

Precisely because of this issue, using a payroll tracker that lets you track and analyze employee hours could help you automate your payroll calculation — and increase the transparency of the entire payroll process.

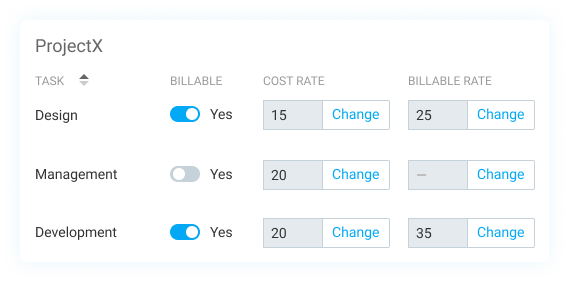

If you use Clockify for managing your company payroll, you can quickly set hourly rates for each employee and instruct them to track the time they spend on each task.

This way, you'll be able to stay on top of payroll expenses and obtain the most accurate payment data within seconds.

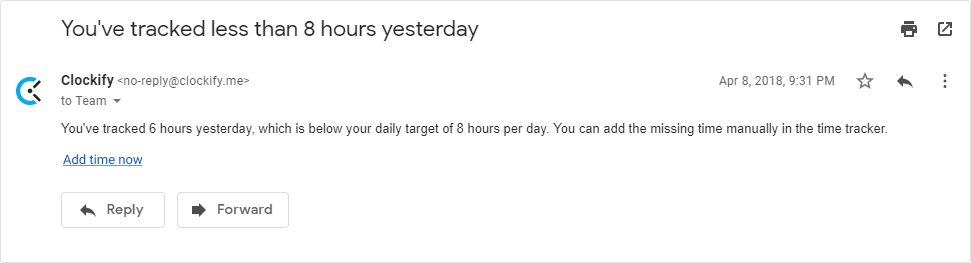

Clockify also lets you set up timesheet reminders to avoid someone forgetting to log their hours before the pay period end date approaches.

Whenever you'd like to take a look at a detailed summary of a certain pay period, you can get detailed visual reports that let you break down and filter all the necessary payroll data.

Apart from giving you the option to check out all the payroll-related information within seconds, Clockify also lets you create custom reports and export them as PDF, CSV, or Excel files.